About ScoNess Enterprise

Our Vision

- ScoNess Enterprise is revolutionizing the Commercial Real Estate Sphere providing investment opportunities that help individuals diversify and grow their portfolios. Current real estate investments span multi-family properties, RV parks, and mobile home communities, with our team and affiliates having an AUM of $70M+.

General Partner (GP) vs. Limited Partner (LP) in Real Estate

General Partner (GP) Also known as: Sponsor or syndicator

- Identify the investment opportunity

- Performs due diligence and underwriting

- Secures financing

- Manages the asset and day-to-day operations

- Distributes profits and communicate with investors

- Risk Profile: Takes on the most operational and legal liability

- Compensation: Usually earns fees (acquisition, asset management) and a portion of the profits through a "promote" or performance-based split

Limited Partner (LP) Also known as: Passive investor

- Contributes capital to the deal

- Relies on the GP for management and execution

- Risk Profile: Liability is typically limited to the amount invested

- Compensation: Receives preferred returns and a portion of remaining profits

- Ideal for: Investors seeking passive income without the time commitment of active property management

- Sophisticated Investor (under 506(b)): A non-accredited investor with sufficient knowledge and experience in financial and business matters to evaluate investment risks.

Accredited vs. Non-Accredited Investors

The Securities and Exchange Commission (SEC) sets specific criteria to determine who qualifies as an accredited investor, which affects who can invest in certain types of real estate syndications.

Accredited Investor

Defined by the SEC under Rule 501 of Regulation D. An investor qualifies if they meet one or more of the following:

- Income Test: Earned income exceeding $200,000 (or $300,000 with spouse) in each of the past two years, with the expectation of earning the same or more in the current year

- Net Worth Test: Net worth (individually or jointly with spouse) exceeds $1 million, excluding the primary residence

- Professional Criteria: Holds certain professional certifications (e.g., Series , 65, or 82), or is a director, executive officer, or general partner of the issuer

Non-Accredited Investor

An investor who does not meet the above criteria. While they may still participate in certain offerings, their access is more restricted under SEC rules.

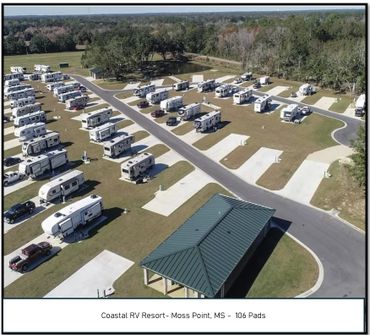

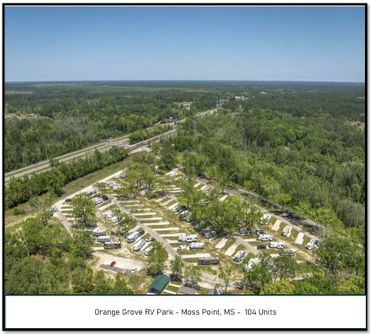

Property Portfolio Preview A Glimpse into a fEW Featured Assets

Contact Us

HAVE QUESTIONS?

WE LOOK FORWARD TO HEARING FROM YOU!

ScoNess Enterprise LLC

United States

Subscribe Under Construction

Sign up for real estate news.

This website uses cookies.

We use cookies to analyze website traffic and optimize your website experience. By accepting our use of cookies, your data will be aggregated with all other user data.